Every technology wave ends the same way: it starts with invention, accelerates with speculation, and resets with efficiency.

AI is following the script perfectly.

The past two years have been the speculative phase. GPU prices soared. AI valuations detached from revenue. Entire industries reorganized themselves around access to closed APIs and compute supply chains. The stock market rewarded growth over economics, and everyone convinced themselves this time was different.

It isn’t.

The coming correction — the AI margin call — will not kill AI. It will expose who’s actually using it efficiently, and who was just paying for hype.

The real constraint isn’t imagination — it’s cost and control.

AI has outgrown its early playground.

Enterprises now feed their most sensitive data into closed systems they don’t own, can’t audit, and can barely afford. Meanwhile, the same companies are being asked to justify cloud bills that grow faster than revenue.

When the economy cools, CFOs will look at AI and see a black hole:

beautiful demos, rising costs, zero proof of privacy, and uncertain ROI.

The next generation of winners will emerge from this reckoning — not by building bigger models, but by rebuilding the AI stack itself: cheaper, verifiable, and under their own control.

What breaks first

When budgets tighten, the weakest links go first.

We’ve seen this before — 2000 for dot-com, 2008 for fintech.

In AI, the first cracks will appear in:

- Closed AI APIs that charge enterprise pricing for commodity inference.

- High-margin SaaS that can be replaced by open-source software.

- Public clouds that mark up compute by 300%.

- GPU supply chains once overextended demand meets reality.

The crash will not come from failure — it will come from arithmetic.

The next cycle: efficiency and proof

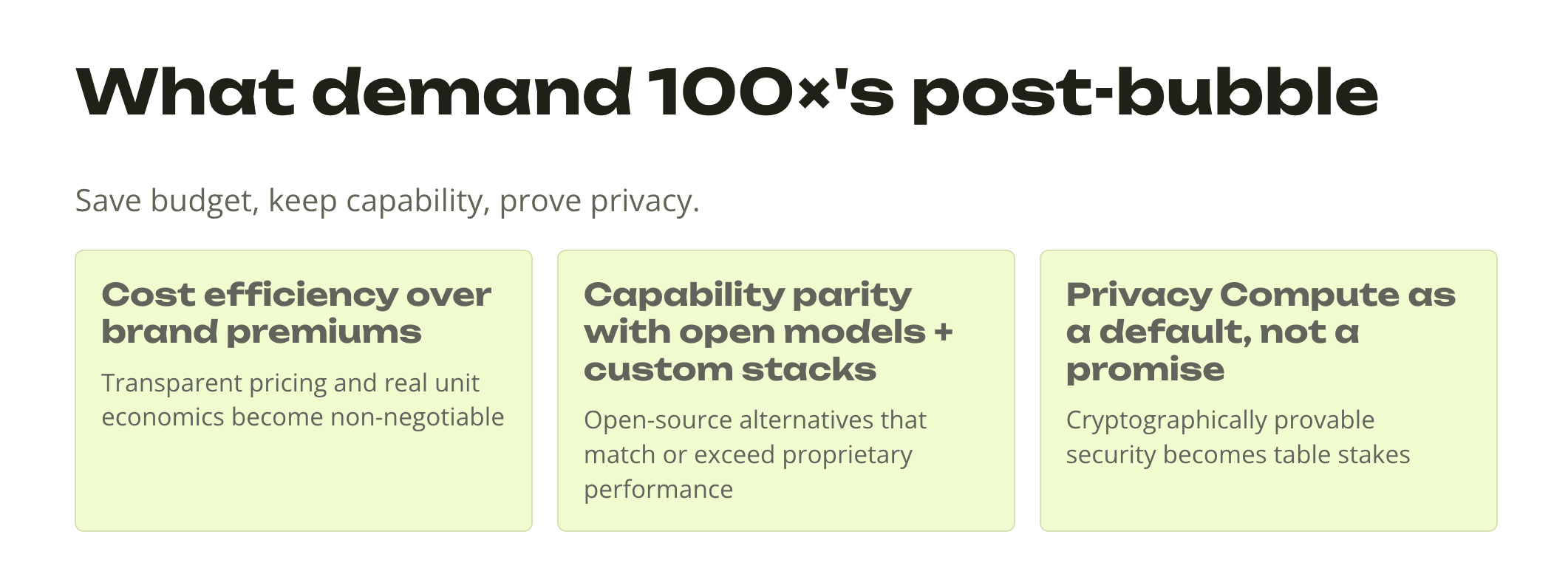

After the correction, demand won’t disappear. It will change shape.

Companies will still need AI — but they’ll need it to be:

- Cheaper: cost must scale with value created, not hype.

- Private: no regulator or board will accept “trust us” as a privacy policy.

- Verifiable: outputs must come with evidence, not marketing slides.

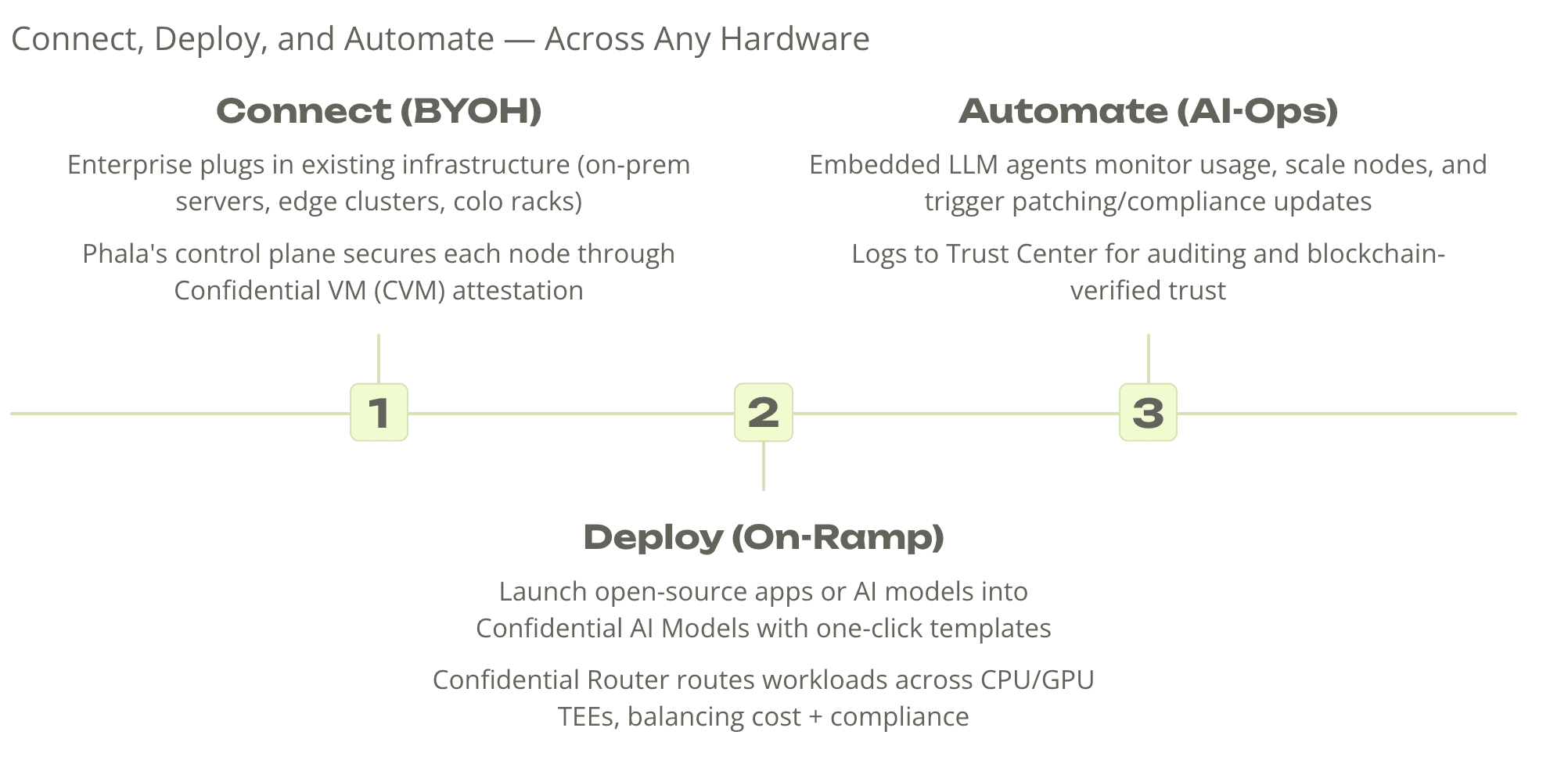

This will mark the rise of private AI — systems that run where the data lives, produce cryptographic proof of what they did, and cost a fraction of today’s infrastructure.

It’s not about “anti-cloud.” It’s about owning the infrastructure of intelligence the same way companies eventually owned their own data warehouses and security pipelines.

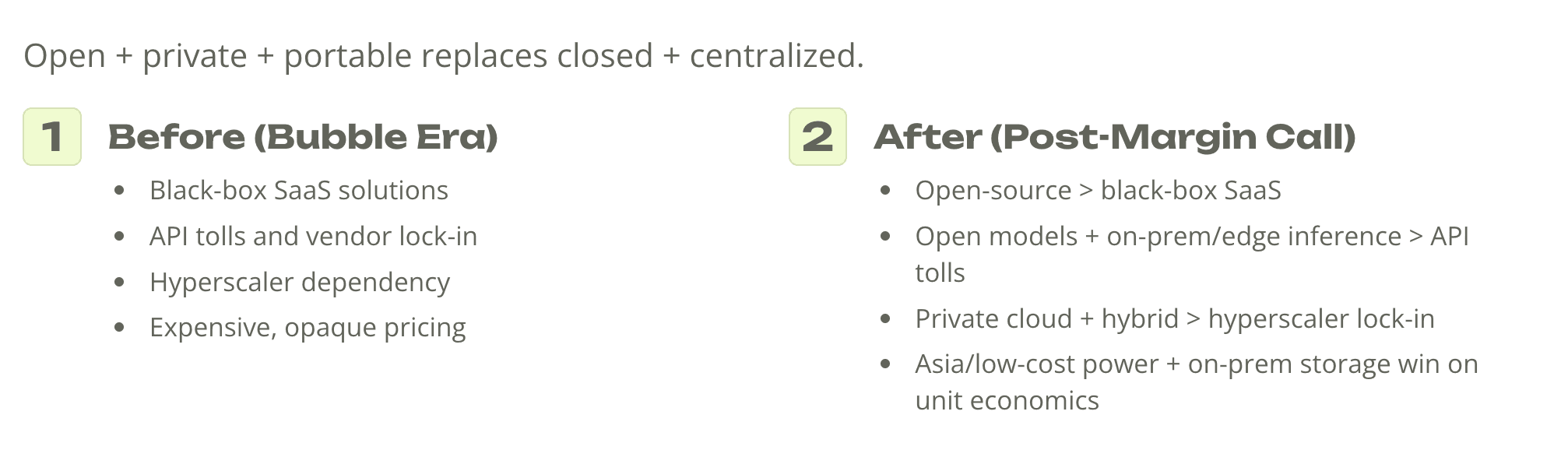

A new architecture for the post-bubble world

In the next few years, the AI stack will quietly rebase itself:

- Open-source software will replace expensive SaaS.

- Open models will replace proprietary APIs.

- Private and hybrid clouds will replace hyperscaler dependence.

- AI will manage infrastructure itself, reducing human overhead and cost.

The combination of open systems and verifiable privacy will become the new baseline — not because it’s idealistic, but because it’s economical.

When margins compress, transparency wins.

The 2026 opportunity window

The last time the market collapsed, it created Google, Amazon, and Salesforce — all built in the rubble of the dot-com crash.

The next reset will do the same for AI.

This time, the breakout companies will come from the infrastructure layer — the teams building the rails for private, verifiable, and cost-optimized AI.

They’ll be the ones who prepared early:

those who treated security and efficiency not as trade-offs, but as survival strategies.

A founder’s reflection

When we started working on confidential computing in 2019, it felt too early.

Now it feels inevitable.

We’re entering a period where the winners in AI will not be the ones who shout the loudest, but the ones who can run the longest — efficiently, privately, and with proof.

That’s the world I’m building toward:

not a bigger AI, but a smarter, smaller, verifiable one.